Loan Processor Pro, LLC

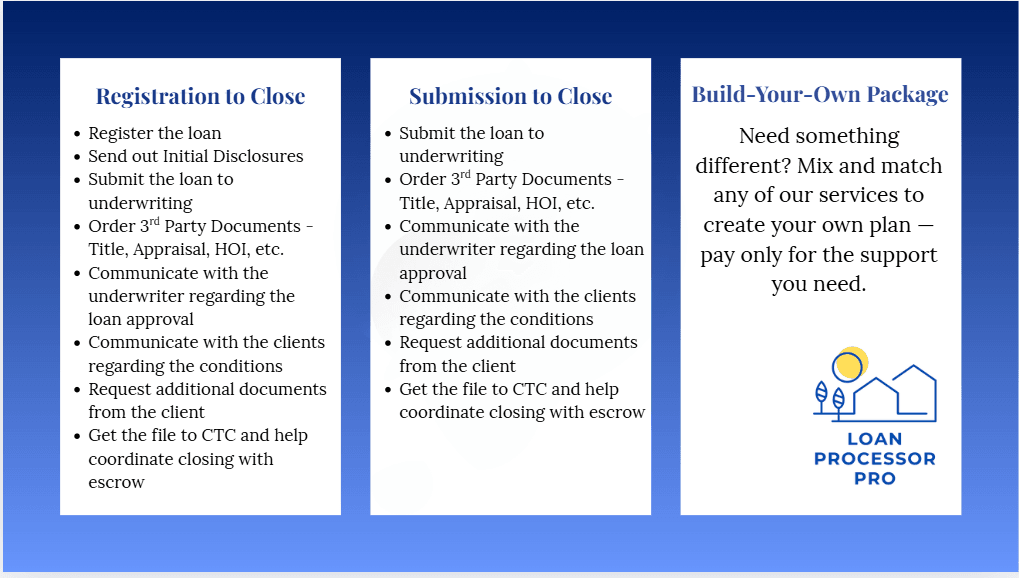

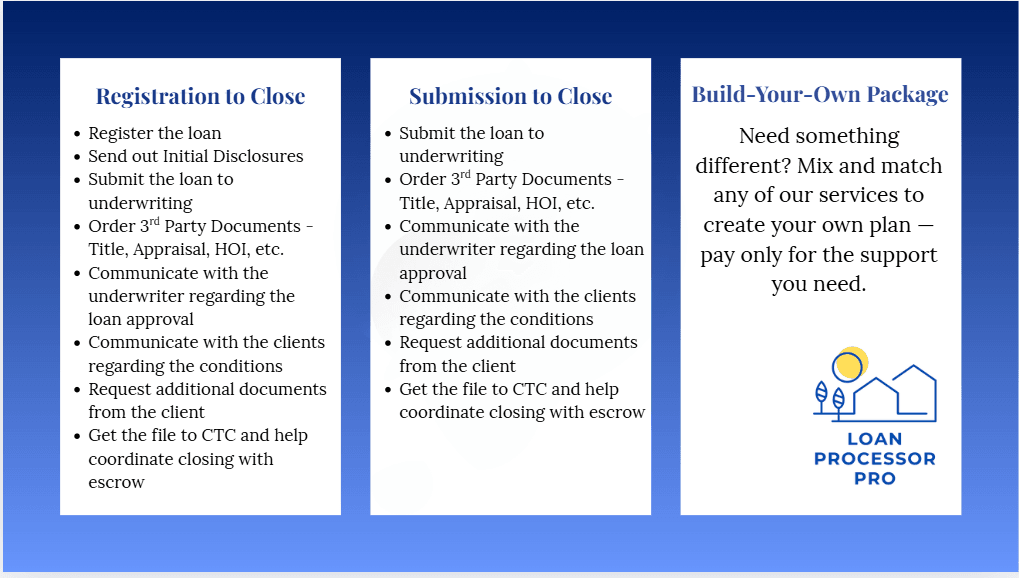

Services

Turn Times

Initial evaluation by the processor completed within one business day after loan assignment.

The registration and submission procedure can only begin if the processor has all required permissions and documents in place.

Review and uploading of conditions will be completed within one business day upon receiving the documentation

The initial approval review will take place the same day if underwriting issues the approval before 2:00 p.m. EST; if not, it will be done first thing the next business day.

Upon notification, all resubmissions—regardless of product or lender—will be handled within two business days, provided that the processor is available.

If CTC Reviews are received by 4:00 p.m. EST on the same day, they will be done; if not, they will be scheduled for the first thing the next business day.

Contact Us

Loan Processor Pro, LLC

Phone: 336-365-1014

Email: info@loanprocessorpro.com

Licensed in CO, FL, GA, NC, TX, and VA

NMLS# 2570334